Tuesday, 7 March 2023

FREE WHELAN: Thin a few profits this week, add a few defensives. Buy bombs or Coca-Cola. Or both.

by Berkeley Lovelace

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Good Morning,

Nothing better than grabbing the pink paper (Financial Times) on a Saturday after a trip to the vet and seeing the Big Read is all about adding to your confirmation bias.

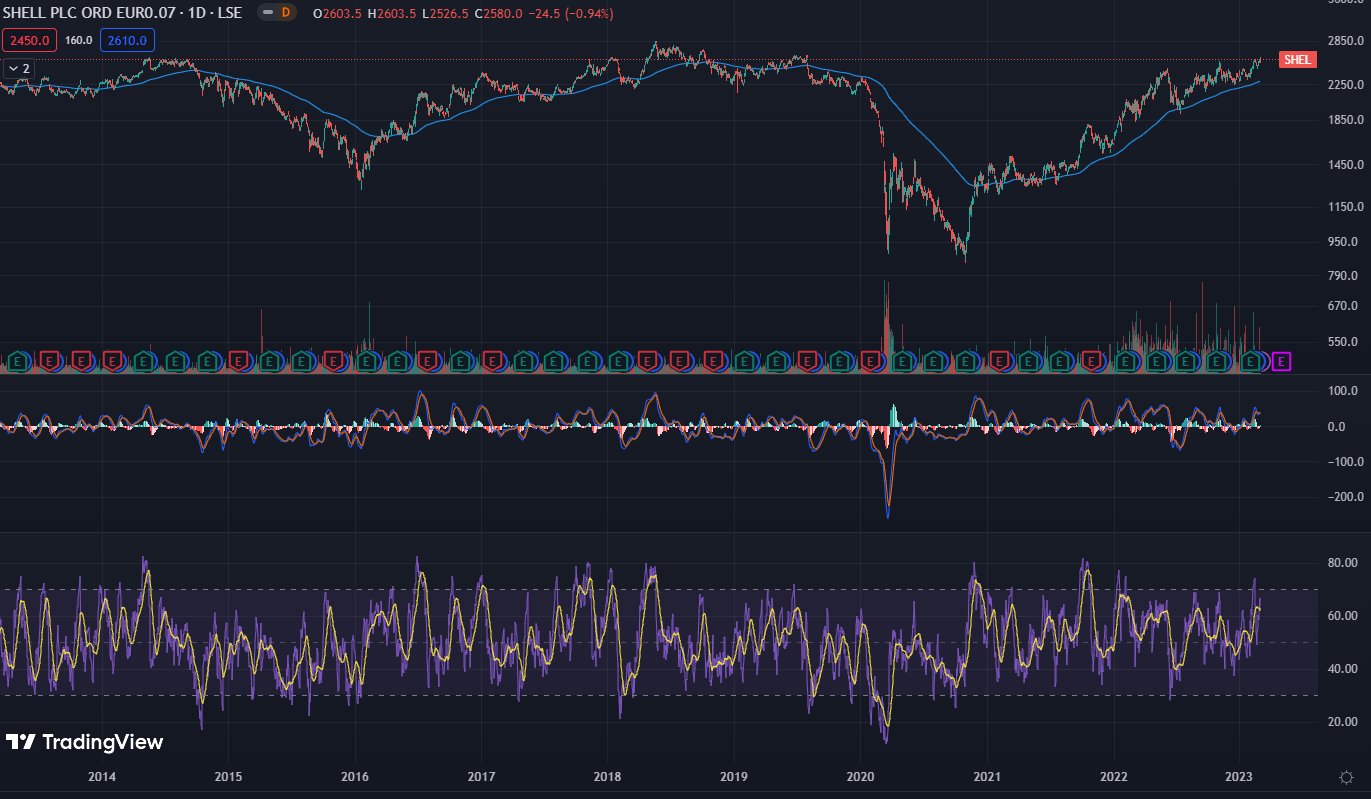

An article about how Shell was aiming to close the valuation gap that a listing in LSE leaves compared to the higher valuation US listed energy companies receive. This quote from an analyst gave me pause…

“To close the gap, analysts say, Sawan (Shell’s top guy) must either convince investors that Shell can deliver more attractive returns from its future low-carbon businesses or maintain higher oil profits for longer, potentially by softening an earlier commitment to allow oil output to fall.”

The power is in the energy companies’ hands. Pick and choose profitability: move to renewables, leave a shortfall in production, profit. Or stick with production but lower output to maximise revenue, profit.

That’s highly simplistic but you can see where I’m getting to it in regards to the advantage of being overweight the oil companies. They choose their destiny.

We went long Woodside (ASX:WDS) last week into a healthy dividend this week and it’s nice to have a profit on the way.

Stay the course.

For the record also Shell is the biggest holding in the FTSE 100 ETF and the FUEL Energy ETF. We’re about where we need to be.

The Beatings Will Continue Until Morale Improves

In other news there’s more news that the Aussie consumer has changed their ways. Maybe. Finally.

Sort of.

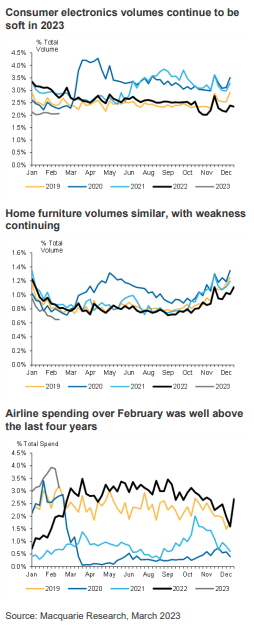

Mac Bank High Frequency Consumer Data continues to point to the fact that a small group of people are determined to ruin it for the rest of us (I sound like a jaded school principal).

Electronics – weak. No one needs a new laptop yet we all went back to the office.

Furniture – weak. No one needs a new couch and the retraction in home building means this is an obvious one.

Airline spending continues to boom. Fair enough. The gates are back open, go and find a horizon somewhere.

So a bit of good news on spending habits along with some things that really can’t be changed. Adds more evidence to the well known fact that older generations are less affected by the derivatives of higher inflation (being higher rates) and will therefore continue to spend on the things they’ve worked hard for.

The generations that have been the most impacted by rate rises are cutting spending.

Those who aren’t, aren’t.

Air German

Lufthansa came out with their numbers on Friday night and wow the airline industry has gone from strength to strength.

Profitability at last with no signs of slowing. I wonder when we get our money back from Qantas?

But in all seriousness I see no reason why this trend won’t continue. I won’t buy airlines but it does bode well for oil consumption.

More China

The Chinese National People’s Congress kicked off on Sunday and the two clanging headlines were that they’re looking to set growth at “around 5%” this year, which is the lowest target in three decades but above current levels. It does sound a lot like my targets to my wife to make it home by “around 7pm” though, but you can guarantee the CCP are better at meeting their targets than I am.

Local markets weren’t overly bullish on this number. We need China strong.

The other news was that they’re looking to increase the military budget by 7.2%, which is above 5.7% planned increase in public expenditure. That’s a theme I don’t think we’ll see reversed either.

No big ideas this week but am having a look at thinning out some profits over the week and buying something in either defence, or defensives. Or both.

One makes bombs, the other makes Coca-Cola.

But this ebb and flow where all of a sudden good news is good news again will fade out and the market will turn back around again.

A note also to hug your dog if you have one.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

The post FREE WHELAN: Thin a few profits this week, add a few defensives. Buy bombs or Coca-Cola. Or both. appeared first on Stockhead.