Tuesday, 7 March 2023

Apollo’s Alpha: New kid on the blockchain Conic Finance could become a DeFi blue chip

by Berkeley Lovelace

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Crypto, shares the fund’s regular take on what’s happening in the fast-changing and volatile cryptocurrency space.

If you’re a firm believer in decentralised finance and, in particular, in two of the strongest DeFi “blue chip” protocols – Curve (CRV) and Convex (CVX) – then you may well be very interested in the latest project Apollo’s thrown a good amount of time into researching. And that’d be Conic Finance (CNC).

Why? Glad you asked. Let’s get into it…

What’s Conic? Actually, what’s Curve and Convex?

To understand Conic Finance, you first need to understand what Curve is, said Apollo’s David Angliss in a Zoom chat with Coinhead. And Convex, too.

And he’s right. So just a very quick refresher on Curve, first then…

“Curve is, basically, the most-used DEX [decentralised exchange] and automated market maker protocol [AMM] for stable assets,” Angliss reminded us. “And it’s got the most liquidity in the industry for stable-asset pairs.”

Curve, for example, makes it easy to swap between Ethereum-based stablecoins such as USDC, USDT and DAI and Ethereum-based “wrapped” Bitcoin tokens, such as WBTC and renBTC.

“We won’t drill into it too much here, but think of Curve as the base-layer DEX – the exchange – and Convex as a second layer that enables the boosting of rewards for the user/liquidity provider on specific Curve pools,” said the analyst.

“And as for Conic, you can think of it a little bit like a Yearn Finance for single-sided liquidity. It essentially offers you an automated strategy that readjusts your exposure across various Curve pools to maximise yield on a fortnightly basis.

“It calls them ‘omnipools’, which are liquidity pools that Conic utilises to allocate a single underlying asset across various Curve pools. So it’s essentially behaving like an active yield farmer for you on top of Curve.”

By way of further explanation, we took a gander at Conic’s minimalistic website, which gives off ye olde OS vibes that we’re not sure is kinda cool or annoying. Or somehow both.

“Conic Finance is an easy-to-use platform built for liquidity providers to easily diversify their exposure to multiple Curve pools. Any user can provide liquidity into a Conic Omnipool which allocates funds across Curve in proportion to protocol controlled pool weights,” reads the Conic website.

And, just to drill it home, in case you’re having trouble following, Angliss added the following to us in some emailed notes:

“Conic Omnipools enable LPs to easily diversify their exposure across Curve. Each Omnipool allocates liquidity of a single asset into different Curve pools. All Curve LP tokens get staked on Convex to boost CRV earnings and to receive CVX.

“In addition to CRV and CVX, Omnipool LPs also earn CNC rewards. Holders can lock their CNC tokens for vlCNC (voted locked CNC) to participate in Conic governance and directly control how liquidity is allocated across Curve pools by participating in Conic’s Liquidity Allocation Votes (LAVs).”

Simple, right? Fact is, you do need to be across how basic principles of DeFi and yield-farming works in order to really get Conic Finance. Treading in with some caution with minimal “test” funds you can afford to lose, and actually having a go at using these sorts of protocols, is the best way to understand them.

1/ Say goodbye to manually changing pools

Conic Omnipools are finally here!

Provide liquidity and start earning $CRV, $CVX, and $CNC rewards

https://t.co/kfdvVZ0G0V

— Conic Finance (@ConicFinance) March 1, 2023

Off to a flyer in terms of usage

Part of what really stands out for Angliss and the Apollo team about Conic so far, is the amount of TVL (total value locked) the DeFi protocol has been able to amass in such a short space of time. TVL can be considered a good metric for indicating the level of activity and health of a DeFi protocol.

“The thing only went live late last week and it’s already hit more than US$61 million in TVL, which is really impressive,” noted Angliss. “This definitely makes it one to watch in the space.”

Sell-off makes it a potentially attractive buy

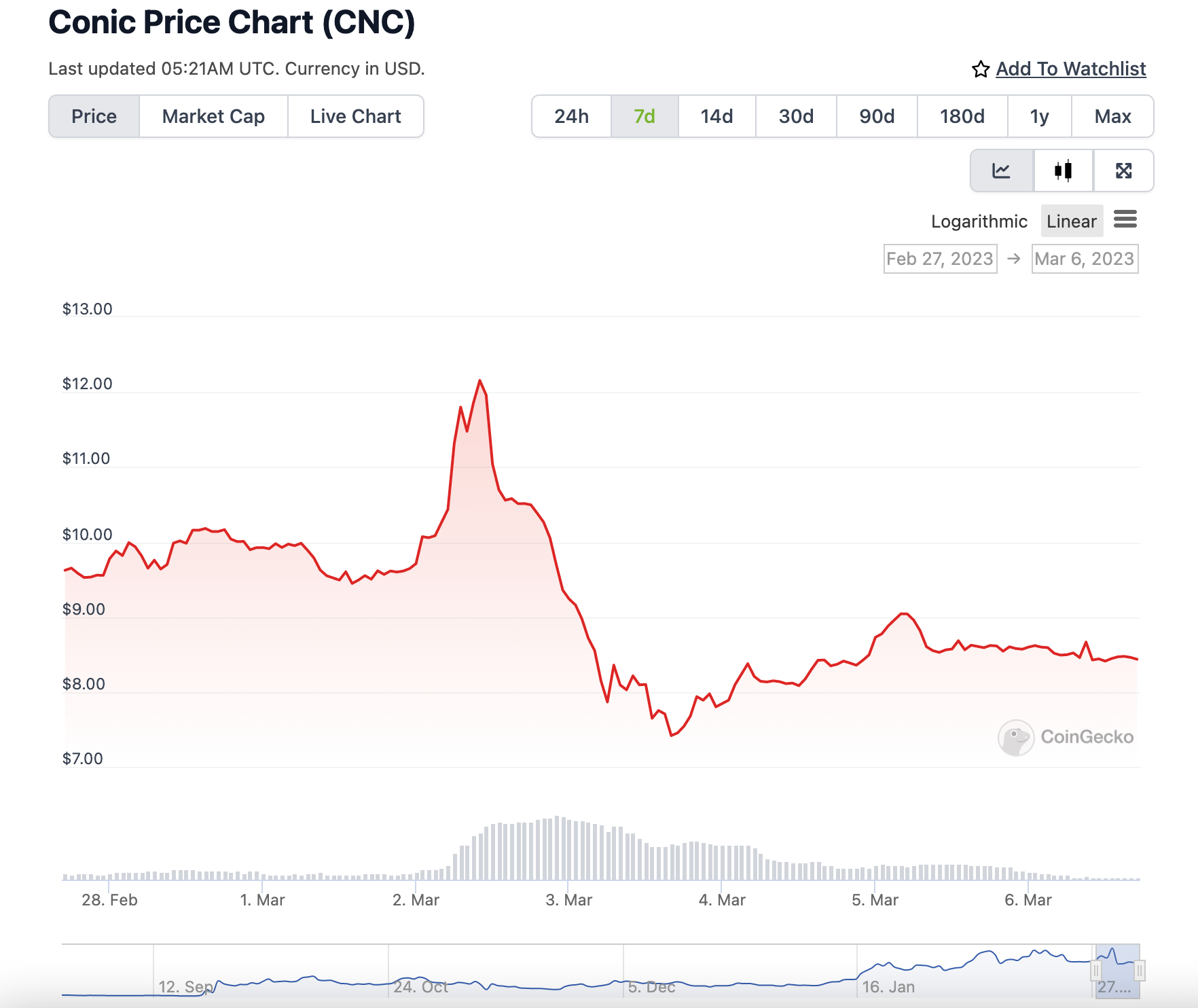

“Another reason I’m excited to talk about Conic right now,” added the analyst, “is that after its omnipools were launched last week, which created a bit of excitement in the DeFi space, there’s been a bit of a sell-the-news event on it.

“And that means there might be some decent opportunities to get into the CNC token at something of a discount.”

The way Apollo manifests its investment thesis into these sorts of DeFi projects, Angliss explained, is by using and testing the protocols themselves with a view to then potentially investing into the assets themselves – ie. in this instance, buying the CNC token.

“We’re looking at Conic very closely. If it does end up passing our rigorous yield-farming tests, then we’ll probably end up adding it to our long-position funds as well.”

Further bullish notes

And just to finish with, here are some other info bites you might want to consider regarding CNC as a potential small investment in the DeFi allocation of your crypto portfolio…

• Conic has been formally audited by the respected blockchain security company Peckshield and the report will be published in the coming days.

• The CNC/ETH Curve pool has been very profitable for liquidity providers so far (with a weekly vAPY* of 16.54%) and has already generated a good amount of trading volume.

• Conic has, in Apollo’s opinion, the potential to sit in the same discussion as DeFi blue chips such as Curve, Convex and Frax. “It has the potential to reach the size of Convex,” said Angliss. And, checking the market cap of both projects, Convex’s is currently about US$447m (fully diluted: $593m), while Conic’s is US$33.4m (fully diluted: $84m).

• In other words, Conic’s valuation is about 13 times smaller than Convex, which means it could have some excellent growth potential if it does, indeed, become as successful a DeFi protocol as Apollo Crypto thinks it might.

* vAPY refers to the annualised rate of trading fees earned by liquidity providers in a DeFi liquidity pool.

None of the information or opinions expressed in this article should be construed as financial advice.

The post Apollo’s Alpha: New kid on the blockchain Conic Finance could become a DeFi blue chip appeared first on Stockhead.