Thursday, 2 March 2023

February Crypto Winners: Bitcoin layer 2 Stacks (STX) stacked up; as did AGIX, FET, GRT and IMX

by Berkeley Lovelace

February in the Cryptoverse. Not nearly as good as January – thanks to increasing regulatory FUD from the likes of Gazza Gensler, plus the good ol’ macro/inflation/recession chestnuts. But still, it wasn’t all a bowl of worry for all cryptos.

In fact, some of it was even pretty good for certain projects and tokens. We’ll drill into those specifics presently, but first… a word on the bull goose crypto. That’d be Bitcoin (BTC), the market mover in chief. How’d it fare in Feb?

According to the data from blockchain analytics gurus Coinglass, it just snuck into the green for the month.

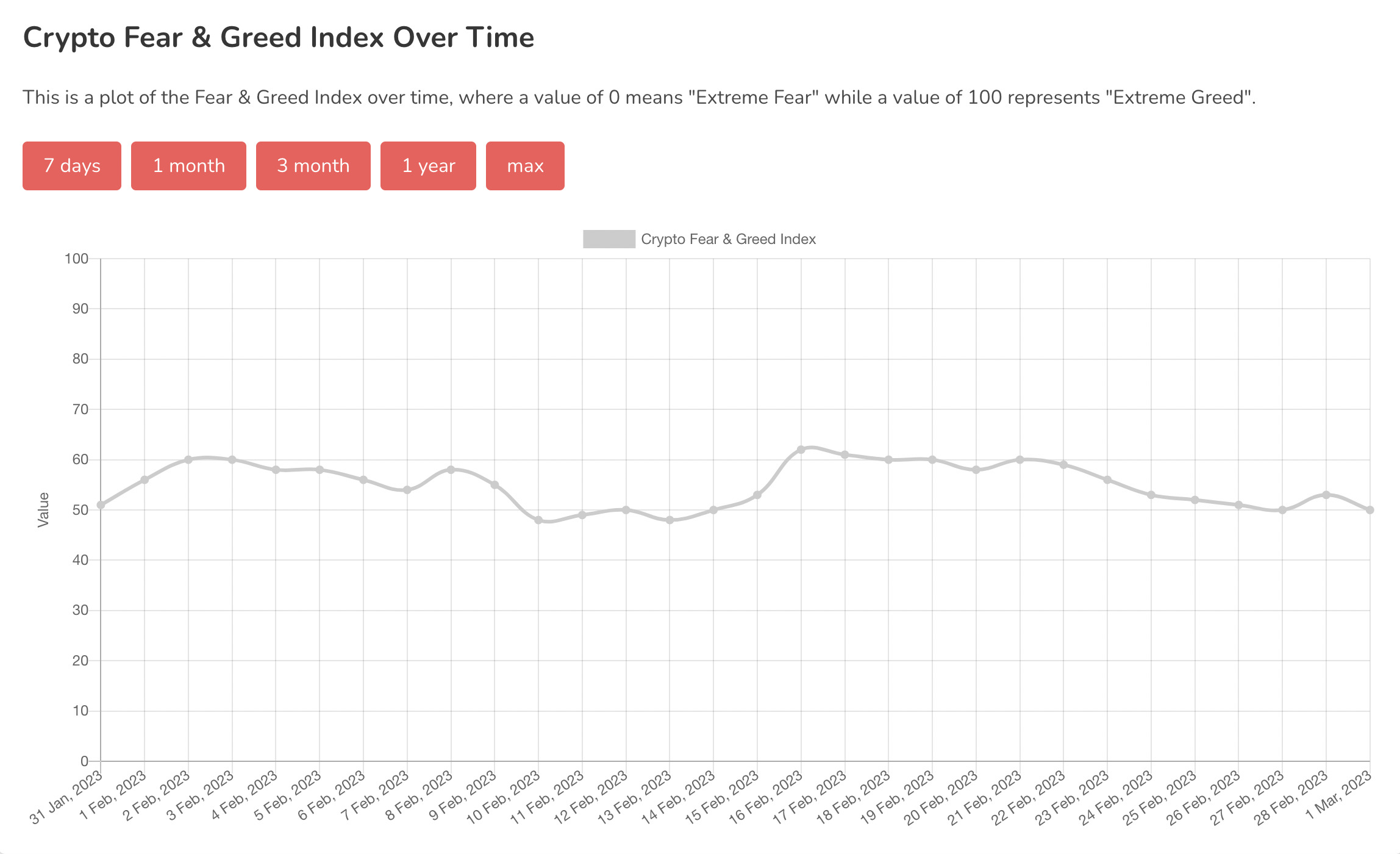

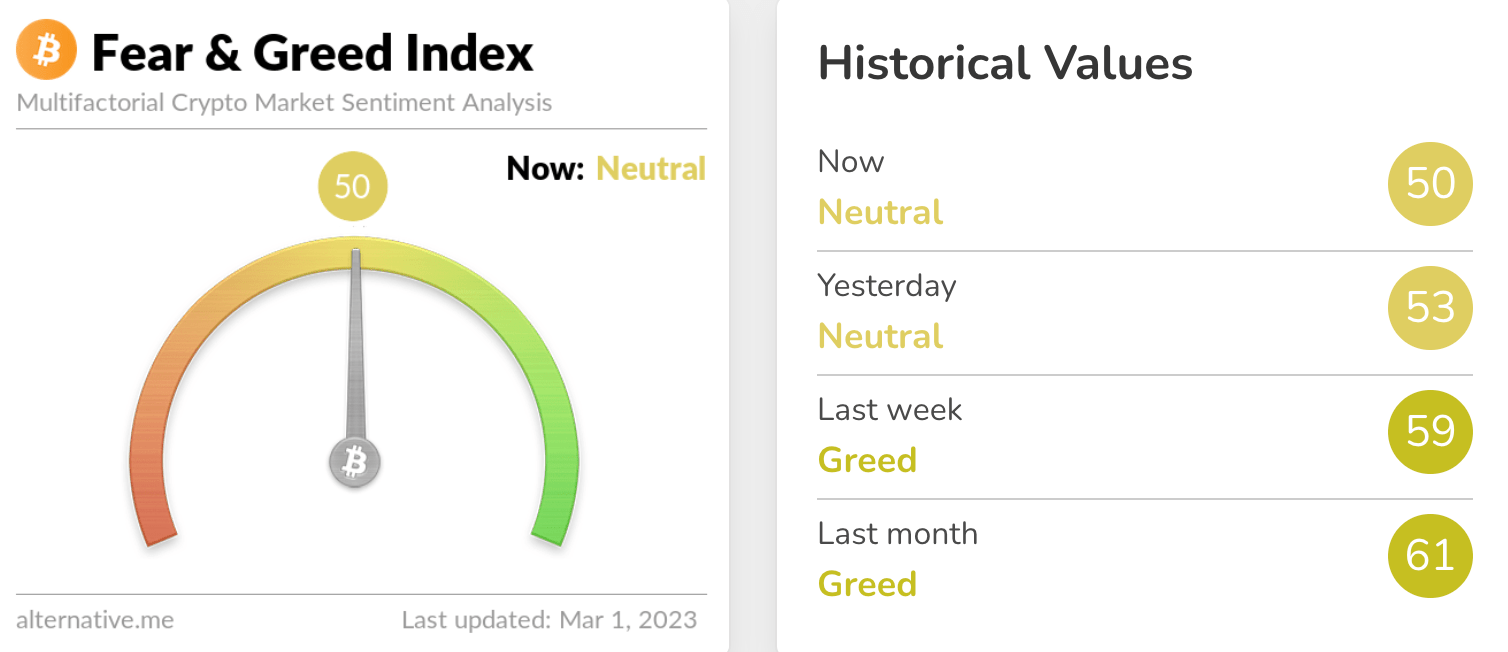

As for leading market sentiment tracker the Crypto Fear & Greed Index, it’s been pretty consistent around a neutral to slightly greedy range in February. Make of that what you will, but one thing’s for certain, there’s been a lot more appetite for crypto-investing-related risk seen so far this year than the second half of 2022.

What can we expect in March, then? Nope, crystal ball not working. Though we do know that if history is any guide (sometimes a dodgy thesis in crypto, bar BTC Halving events), then perhaps we’d best “beware the ides of March”.

Why? If you look at that Bitcoin Monthly Returns table above, and remove the statistical anomaly that was 2013 from the equation, then March’s form isn’t exactly scintillating, notes beaut Aussie crypto Twittering analyst Miles Deutscher.

2023 is off to a good start for #Bitcoin, with 2 consecutive green months (assuming today’s monthly close holds).

But looking ahead: Historically, March has been the 2nd worst performing month – with an average $BTC return of -5.72% (exc. 2013).

What’s your outlook for March?

pic.twitter.com/jm3JB0JJ0y

— Miles Deutscher (@milesdeutscher) February 28, 2023

One thing, though, the Bitcoin monthly close has managed to hit at least one analyst’s target for potential positive progression, with Rekt Capital’s next monthly breakout target looking like US$25k.

New #BTC Monthly Candle Close is in

Given how the Macro Downtrend is a sloping trendline, that means that the breakout price is now lower compared to February$BTC Macro Downtrend breakout price is now ~$25000#Crypto #Bitcoin pic.twitter.com/zsBm8X7oLq

— Rekt Capital (@rektcapital) March 1, 2023

We would try to look further ahead instead of behind, but that’s not what this article’s about. So it’s time instead to examine some of the altcoins that crushed it over the past month.

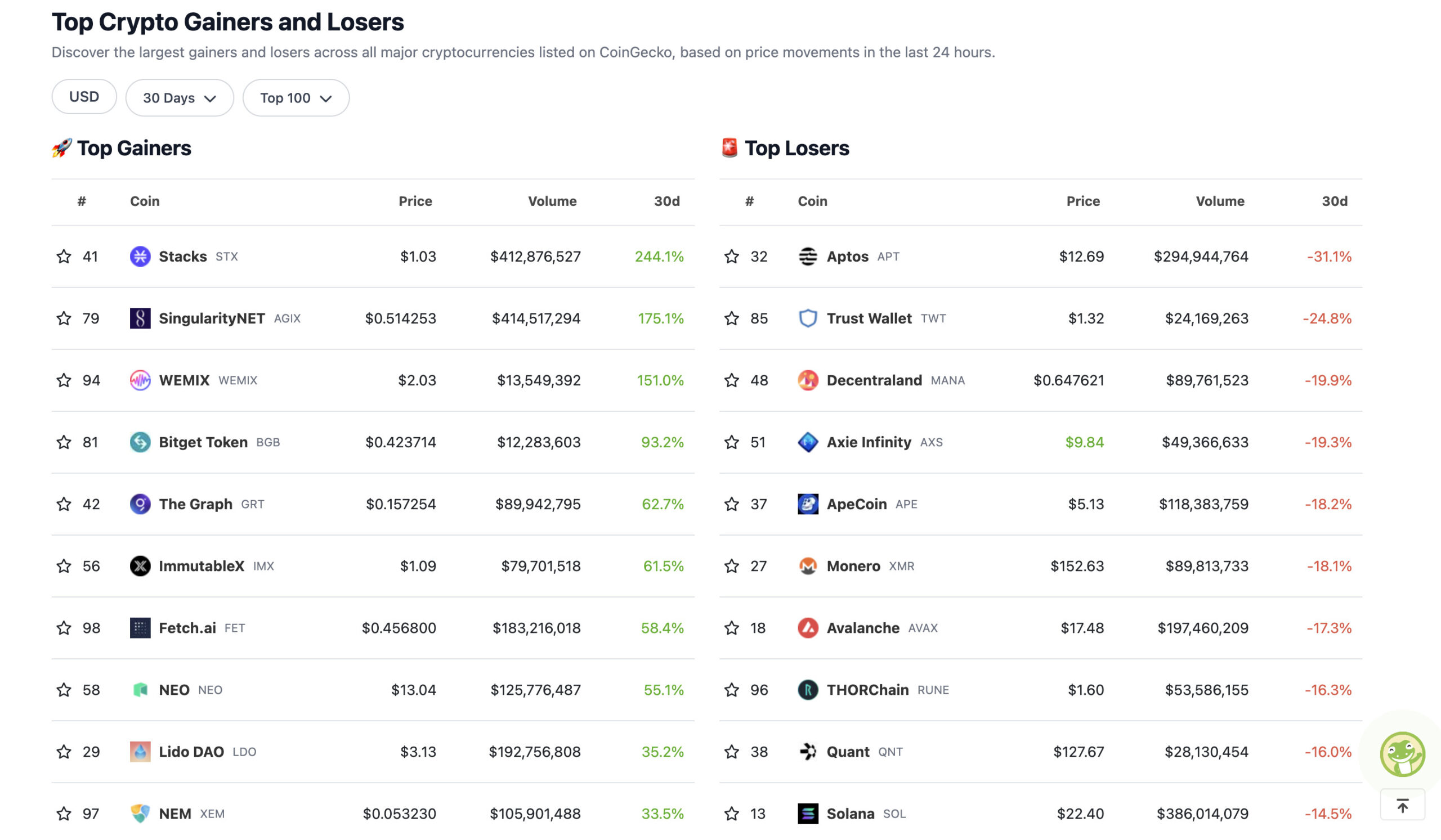

February’s 10 leading gainers in the top 100 (and some losers)

According to CoinGecko data…

Let’s talk about STX

Stacks (STX), the “layer 2” network for the Bitcoin blockchain, has set February alight with a 244% gain. More to the point, perhaps, the Bitcoin NFT “inscriptions” project has set the Bitcoin-as-a-base-layer narrative alight. And Stacks has been a beneficiary of all that excitement, which Kraken’s Jonathon Miller discussed with us recently.

Stacks is a developing blockchain layer with a mission to enable smart-contract-based DeFi, NFTs and decentralised apps on the Bitcoin network. The thing is, however, fundamentally, it really has nothing to do with the success of Ordinals as a project so far.

We say so far, because there is the thought that Stacks could make Bitcoin Ordinals assets more readily accessible to users through minting processes and marketplaces, as opposed to the difficult process of buying them at present, which is more akin to purchasing Bitcoin in its early, pre-exchange days – e.g. tracking down and trusting individual sellers.

Stacks is not there yet, but it certainly has plenty in development and it has a growing community of investor-fans, even if Bitcoin maxis think the OG asset should simply stick to its store-of-value and Lightning-payment narratives. A potential upgrade, for instance, however, includes Ethereum compatability and bridging.

Ordinals have catalyzed a cultural shift in #Bitcoin that will work to $STX‘s benefit. For those that want more programmable uses of $BTC, applications built on top of @stacks will provide what they seek. https://t.co/icPTUGrMFQ

— Chris Burniske (@cburniske) February 26, 2023

Other standouts: AGIX, GRT, IMX, FET

AI tokens surged late January and into early February, cooling off somewhat at times. Overall, however, the likes of SingularityNET (AGIX) and Fetch.ai (FET) have maintained some pretty hefty gains.

The Graph (GRT), too. Although we’re still a little unsure why the popular indexing protocol tends to be classified in the AI trend. Decentralised big-data, yes, but we’re not seeing any mention on its website regarding artificial intelligence technology to forward its blockchain-data-organising goals.

We’re aiming to chat to someone from The Graph, or its original developers Edge & Node, soon, actually, so we’ll hopefully get some clarification on that from them then.

A new Indexer enters the fray

Edge & Node is proud to announce that we’re launching our own full-fledged indexing node to serve queries on The Graph’s decentralized network

https://t.co/3HMNKxuScm

— Edge & Node (@edgeandnode) February 28, 2023

Although it was built on Ethereum, SingularityNET has a prominent partnership with one of the leading layer 1 protocols and Ethereum rivals, Cardano (ADA). SingularityNET is pushing the decentralisation angle, and its migration to Cardano has so far seen it offer an ADA staking service on a blockchain that’s regarded by many as the most decentralised around, with the majority of the ADA token staked.

As an ecosystem that promotes openness, we believe the best way to deliver impact and bring about beneficial #AGI is decentralization.#SingularityNET is building a common #AI marketplace to democratize access to the benefits of breakthrough innovations. https://t.co/56mdrJiLqn

— SingularityNET (@SingularityNET) February 28, 2023

Another notable performer was the Aussie-built gaming-focused layer 2 Ethereum blockchain ImmutableX (IMX). Despite some recent staff restructuring – okay, lay-offs – this is a project that keeps on building and growing in terms of its partnerships.

Pretty much every other day there’s a press release sitting in the Coinhead inbox regarding a new Web3 game or NFT project deciding to migrate to, or build on, ImmutableX. We picked up on zombie shooter Undead Blocks’ IMX partnership, for instance, and you can read more about that project and its founder here.

But here’s some other recent news we didn’t get to in depth. ImmutableX has just announced it’s launched a Unity gaming engine SDK (software development kit). Other than the fact more than 50% of all video games are built on Unity, here’s why co-founder Robbie Ferguson thinks that’s such a big deal for his blockchain firm and the gaming developers choosing to work on it:

Announcing the @Immutable Unity SDK: enabling game developers to build Web3 games directly in Unity.

This is an enormous step for us, but also for the entire industry. More than >50% of *all* games are built with @unitygames. https://t.co/v1oYkXC5pH pic.twitter.com/gV4Bo3kKjQ

— Robbie Ferguson 🅧 | Immutable (@0xferg) February 28, 2023

February’s 10 leading gainers and losers in the top 300

Zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

A bit like us, Collective Shift analyst and crypto educator Matt Willemsen is perhaps rueing a missed Stacks opportunity in Feb. Can’t catch ’em all, though.

Okay now this is just annoying.

Congrats to any $SSV holders out there (not me… again

) pic.twitter.com/UoIaodMGBK

— Matt Willemsen (@matt_willemsen) February 27, 2023

The post February Crypto Winners: Bitcoin layer 2 Stacks (STX) stacked up; as did AGIX, FET, GRT and IMX appeared first on Stockhead.